What Buyers and Sellers Should Know About Today’s Market in Polk County, Florida

In the dynamic real estate market of Polk County, Florida, it’s crucial for both buyers and sellers to stay informed about current trends to make well-informed decisions. This market update provides key insights to help you navigate the local housing landscape.

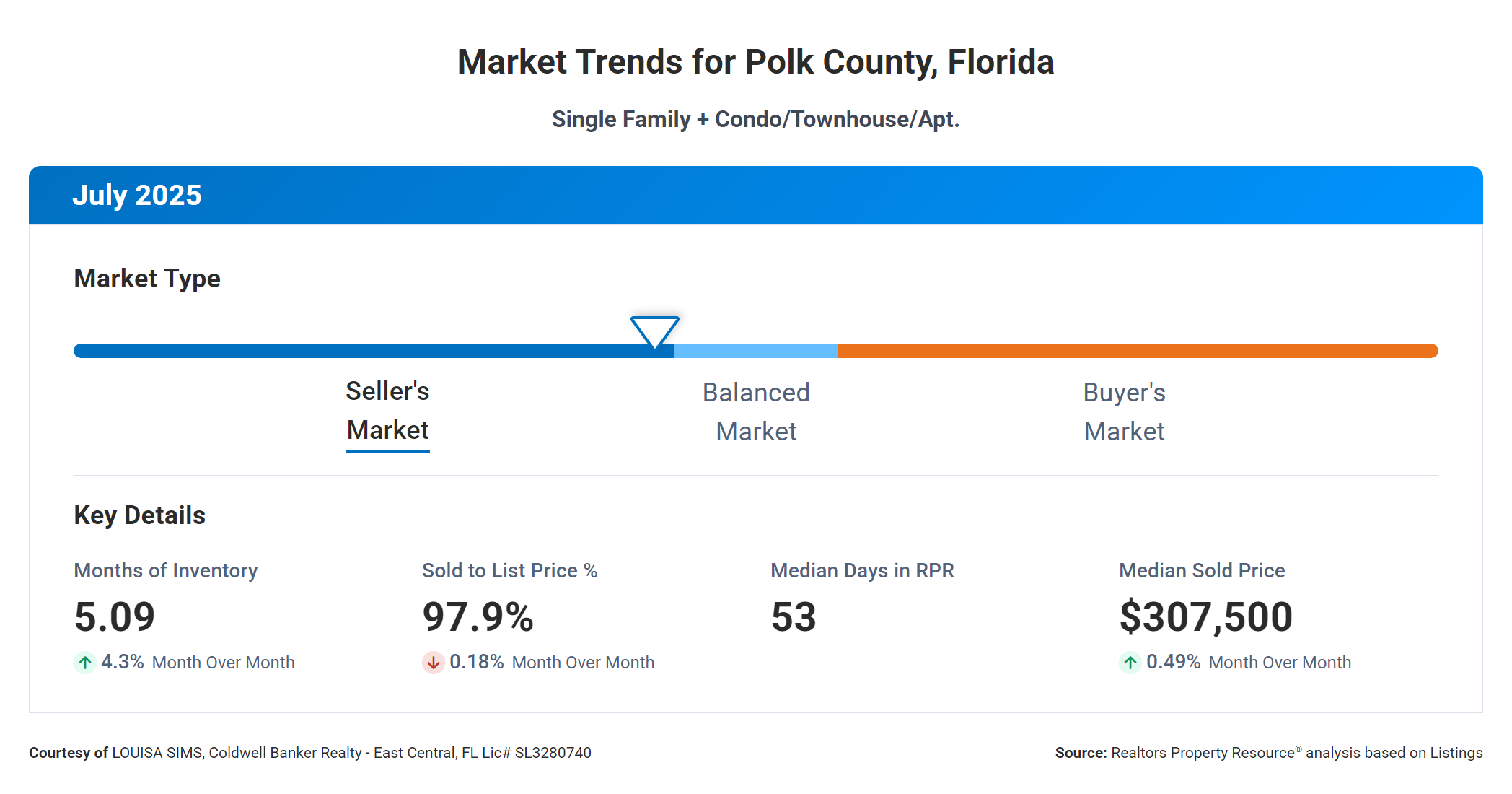

The current months of inventory stand at 5.09, indicating that Polk County is experiencing a balanced market. In such a market, neither buyers nor sellers have a distinct advantage, making it an opportune time for negotiations to be fair and balanced. For buyers, this means a reasonable selection of properties without the pressure of overbidding, while sellers can expect steady interest in their listings.

Recent inventory trends show a modest growth, with a 4% increase over the past month and a more significant 63% increase over the past year. This increase suggests a gradual rise in available homes, potentially easing some of the competitive pressure observed previously. Buyers may find more options as the inventory expands, while sellers should consider the growing competition when setting their listing prices.

The sold-to-list price ratio in Polk County currently stands at approximately 98%. This indicates that homes are selling for about 98% of their asking price, reflecting a market where sellers may need to be flexible with pricing to attract serious buyers. It’s important for sellers to price their homes strategically to align with market conditions, while buyers can feel confident in negotiating fair deals without overpaying.

The median days on market for homes is 53, suggesting a steady pace in the buying and selling process. This timeframe provides buyers with a reasonable window to conduct thorough research and make informed decisions, while sellers should be prepared for a slightly longer wait before closing a sale compared to faster-moving markets.

The median sold price in Polk County is currently $307,500. This figure serves as a benchmark for both buyers and sellers. Buyers should use this as a reference point for affordability and budget planning, while sellers can gauge how their property compares to the median pricing in the area.

For personalized guidance tailored to your specific real estate needs in Polk County, Florida, contact Louisa Sims at Coldwell Banker Realty – East Central. She can provide expert advice and assistance whether you’re buying or selling in this balanced market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link