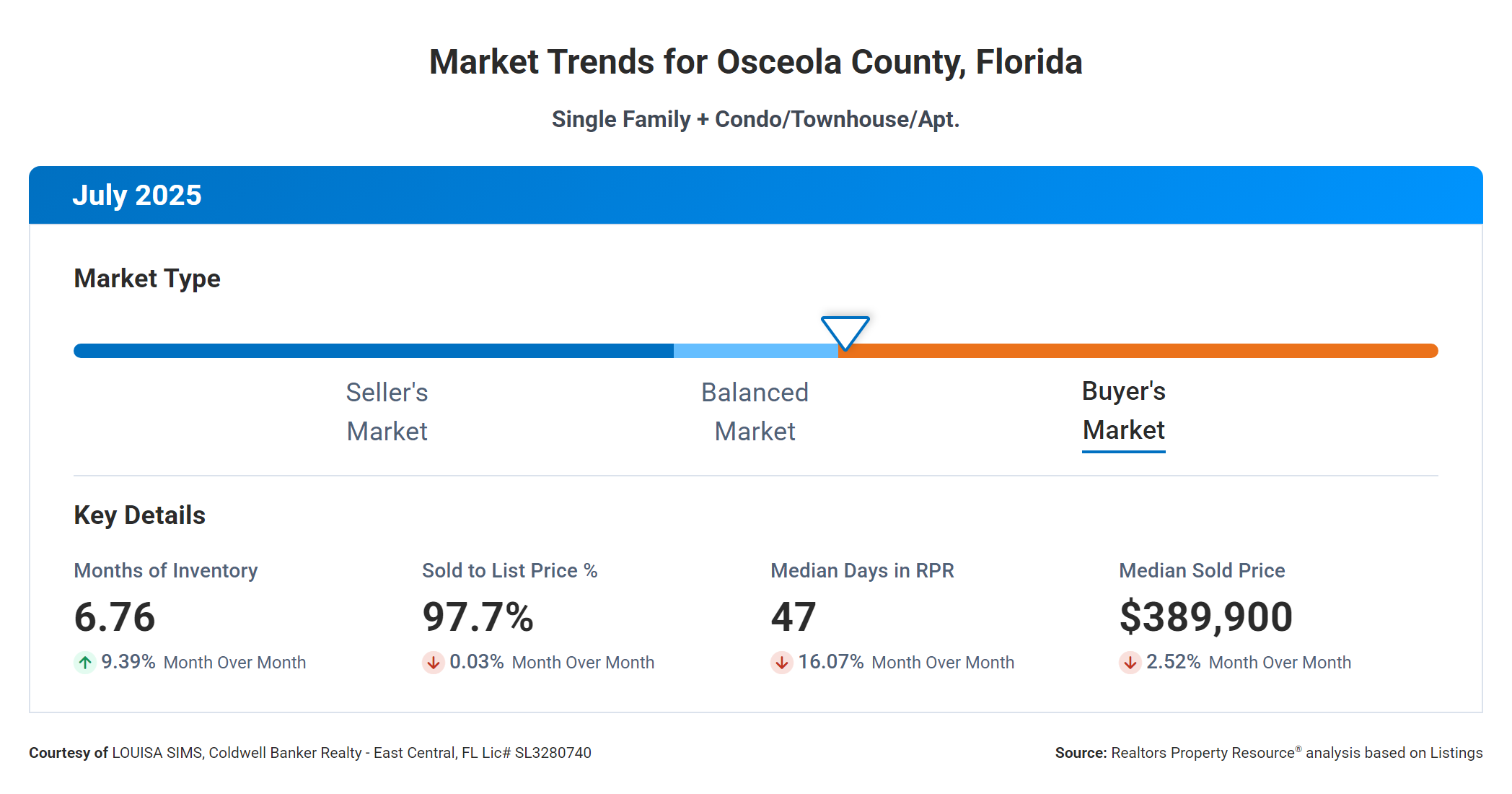

What Buyers and Sellers Should Know About Today’s Market in Osceola County, Florida July 2025

Staying informed about the housing market is crucial for both buyers and sellers looking to make strategic decisions. In Osceola County, Florida, understanding current market trends helps you navigate timing, pricing, and overall strategy effectively. Here’s what you need to know about the current market conditions.

With a months of inventory figure at 6.76, Osceola County is currently experiencing a balanced market. This means that neither buyers nor sellers have a distinct advantage right now. In a balanced market, both parties have an equal opportunity to negotiate, making it an ideal time for buyers to find homes without excessive competition and for sellers to set realistic expectations on pricing and negotiation.

Examining the inventory trends, the short-term trend shows a slight increase of 9%, while the long-term trend over the past year is up by 107%. This indicates a gradual increase in available homes, suggesting that more options are becoming available, which could slowly ease competition for buyers. For sellers, this means pricing competitively is more important than ever to attract potential buyers.

Homes in Osceola County are currently selling for about 98% of their asking price. This suggests that sellers are generally achieving close to their desired prices, but there is still room for negotiation. Buyers can expect to pay near the listed price, while sellers should be prepared for offers that might come slightly below their initial asking price.

The median days on market stands at 47, which indicates a steady pace. Homes are neither flying off the market nor sitting unsold for long periods. For buyers, this means there is sufficient time to consider options without feeling rushed. Sellers, on the other hand, should ensure their homes are well-presented and competitively priced to capture buyer interest within this timeframe.

Lastly, the median sold price is currently at $389,900. This figure helps frame pricing expectations for both buyers and sellers. Buyers should consider this as a benchmark for affordability, while sellers can use it to gauge where their property stands in comparison to the average market price.

For personalized guidance tailored to your specific circumstances, feel free to contact Louisa Sims at Coldwell Banker Realty – East Central. Whether you’re buying or selling, having an experienced professional by your side can make all the difference in achieving your real estate goals.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link