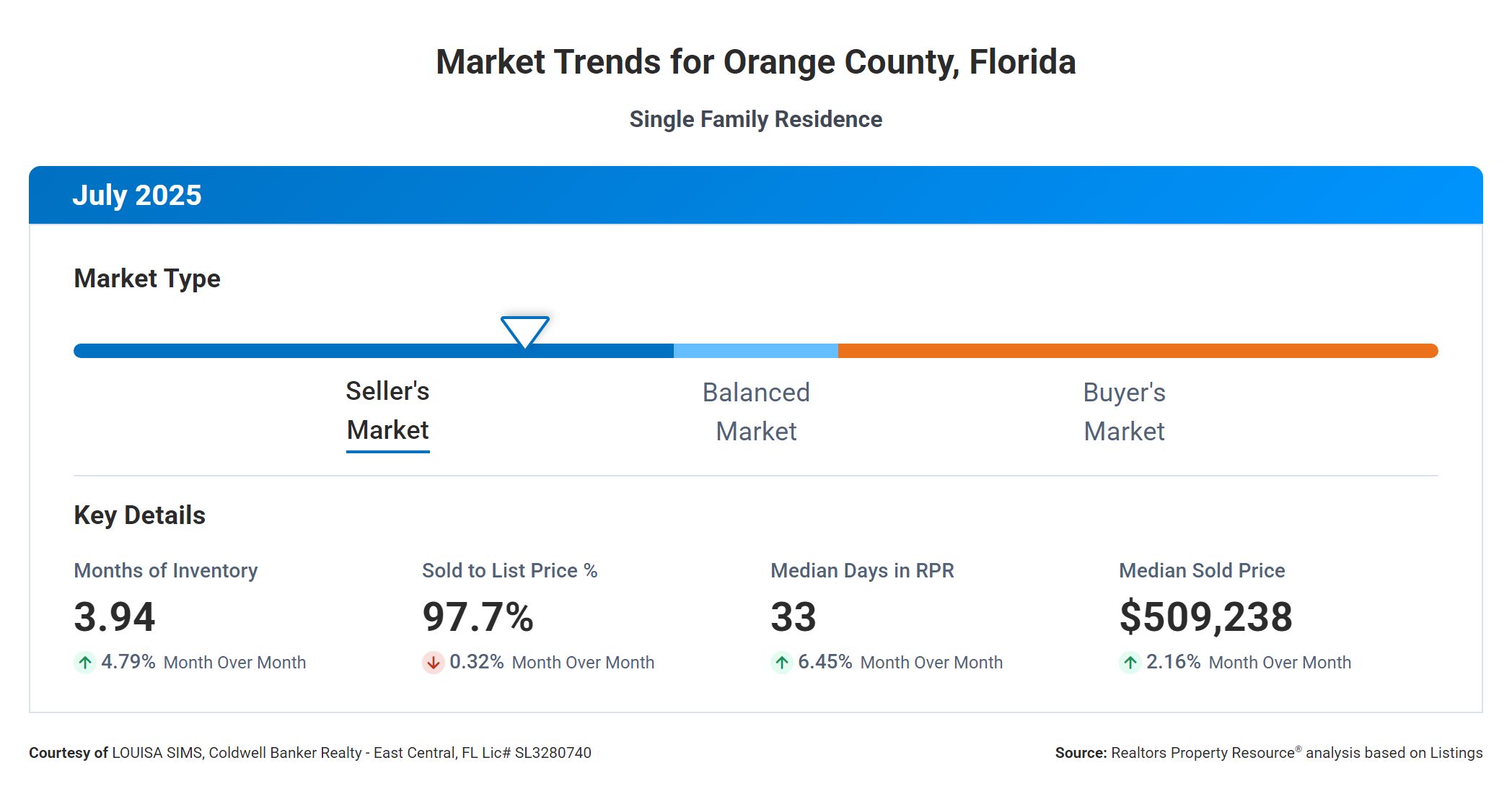

What Buyers and Sellers Should Know About Today’s Market in Orange County, Florida Data July 2025

As the housing market in Orange County, Florida continues to evolve, understanding current trends is crucial for both buyers and sellers. Whether you’re considering making a move or evaluating your current position, staying informed can help you make the best decisions in a dynamic market.

The current months of inventory stand at 3.94, indicating a seller’s market. For sellers, this means there is relatively lower competition, which can be advantageous when setting prices and negotiating deals. Buyers, on the other hand, might face more competition for available homes, so acting quickly and being prepared to make strong offers could be beneficial.

Looking at inventory trends, there has been a slight increase over the short term at 5% and a more notable rise over the past year at 81%. This indicates a gradual increase in available homes, which could start to ease some pressure on buyers over time. However, the current market still leans towards favoring sellers, and both parties should keep a close eye on these trends as they plan their strategies.

Homes in the area are selling for about 98% of their asking price. For sellers, this suggests that pricing homes competitively is key to attracting serious offers without significant reductions. Buyers can expect to pay close to the asking price, so understanding the market value of homes in your desired area will be crucial when making an offer.

The median days on the market for homes in Orange County is 33, indicating a steady pace. For sellers, this means that while homes are selling at a reasonable rate, it’s important to price strategically to avoid prolonged listings. Buyers should be prepared to act promptly, as desirable properties may not remain available for long.

With a median sold price of $509,238, understanding affordability and setting realistic budgeting expectations is essential. Sellers can use this figure as a benchmark to price their homes competitively, while buyers should assess their financial readiness and explore mortgage options that align with this range.

Whether you’re buying or selling, navigating the current housing market requires a strategic approach tailored to your unique needs and circumstances. For personalized guidance and to explore your options further, contact Louisa Sims at Coldwell Banker Realty – East Central.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link